Transition Economics was commissioned by the Scottish Trades Union Congress to analyse ScotWind projects, including ownership, potential job creation, and the infrastructure and supply chains needed to deliver on investment committed by offshore wind developers.

Our full report is available here Scotwind: The Investment needed to secure manufacturing jobs in Scotland

STUC’s press release launching the report is here: ‘Hot Air’: STUC Report Exposes £2 Billion Black Hole in Government Green Jobs Ambitions

Launching the report, STUC General Secretary Roz Foyer said:

“Our ScotWind report released today, the latest in our analysis of Scotland’s green energy economy, shows that politicians have their head in the sands with a £2 billion gap in the funding needed to build our domestic supply chain.”

“In order to reach the target of 25,000 jobs, Scotland needs a minimum of 19 manufacturing sites. We currently have zero. That’s a chronic indication of the political rhetoric clearly not matching the action needed to do what is right by our energy workers.”

Summary of our analysis on ScotWind investment, ownership, potential job creation and investment needed to deliver supply chains and jobs:

- ScotWind developers have committed to invest 38% of their overall supply chain spend in Scotland – equivalent to almost £30 billion.

- If ScotWind developers do actually source from Scotland at the scale committed to, this could potentially deliver peak direct employment of 25,000 jobs.

- The potential average direct & indirect jobs per annum are 3,500 over 10 years of development, 19,700 over 9 years of manufacturing & fabrication, 7,100 jobs over 9 years of installation, 2,000 jobs over 26 years of operations, and 455 jobs over 8 years of decommissioning if ScotWind developers meet their commitments. These phases will be partially overlapping as individual projects are initated at different times.

- However, to reach the job creation potential and domestic procurement ScotWind developers have promised, there needs to be an enormous ramp-up in the Scottish supply chain for offshore wind.

- Scotland will need 19 significant fabrication sites for offshore wind components (e.g. blades, nacelles, towers, foundations, floating substructures, cables). Currently, Scotland has 0 significant fabrication sites. Only 2 significant fabrication sites are currently in development, with approved sites and initial funding allocated.

- Existing public investment to scale up Scotland’s domestic supply chains for offshore wind is a drop in the ocean compared to the £2.5 billion – £4.5 billion required. Currently there is less than £600 million on the table – between 13% and 23% of what is needed.

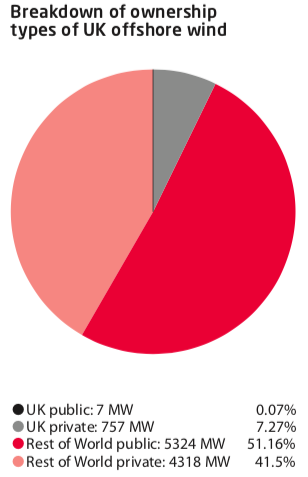

- We estimate the total Net Present Value (value of future profits) of ScotWind projects at between £7 billion (at an Internal rate of return of 4%) to £29 billion (at an Internal rate of return of 8%).

- Greater public investment also needs to be combined with an industrial strategy setting accountable conditions to grow domestic supply chains, alongside a publicly-owned Scottish energy champion able to use its heft to make long-term commitments to domestic suppliers.